What is Forex Trading?

Forex, short for "foreign exchange," refers to the global marketplace for trading national currencies. It operates as the largest and most liquid financial market in the world, offering countless opportunities for traders and investors. Understanding Forex involves grasping its scale, participants, and the mechanisms through which currencies are exchanged. Learn what is forex trading, the basics like currency pairs, exchange rates, and major markets. Explore trading strategies, tools, and risk management. Here’s a comprehensive look at Forex:

1. Overview of Forex

-

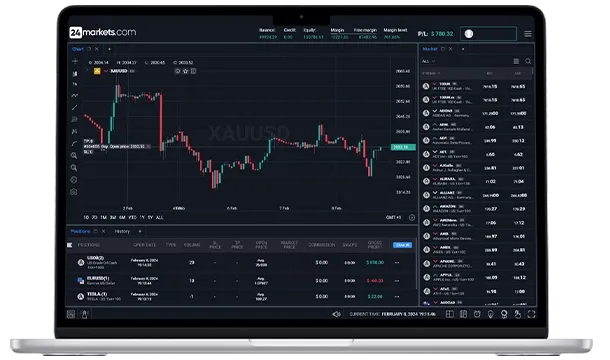

Definition: Forex trading involves the buying and selling of currencies to profit from fluctuations in exchange rates. Unlike centralized markets, Forex operates through a decentralized network of banks, brokers, and financial institutions, enabling continuous trading 24 hours a day, five days a week. This global network ensures that the market remains active and accessible around the clock. For more information on how the Forex market functions, visit the Forex page on 24markets.com.

-

Market Size: The Forex market is unparalleled in size and liquidity, with an average daily trading volume exceeding $6 trillion. This immense scale means that Forex trading involves high liquidity, allowing traders to enter and exit positions with minimal price impact. High liquidity also results in tighter spreads, which can reduce the cost of trading. For insights into the market's scale and liquidity, explore the Forex page.

-

Participants: The Forex market features a diverse range of participants. Central banks trade currencies to stabilize their national currencies and influence monetary policy. Commercial banks, on the other hand, facilitate currency exchange for their clients and engage in speculative trading. Hedge funds and multinational corporations use Forex trading to hedge against currency risks or to speculate on currency movements. Retail traders, including individual investors, participate through trading platforms like 24markets.com. Each group has distinct motives and strategies in the market.

2. How Forex Trading Works

-

Currency Pairs: In Forex trading, currencies are quoted in pairs. Each pair includes a base currency and a quote currency. For example, in the EUR/USD pair, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. Trading involves buying one currency and selling another. If you expect the Euro to appreciate against the US Dollar, you would buy EUR/USD. For detailed information on how currency pairs work, visit the Forex page.

-

Exchange Rates: The exchange rate represents how much of one currency is needed to purchase another. These rates fluctuate based on various factors, including economic data, geopolitical events, and market sentiment. For instance, if the Euro strengthens against the US Dollar, the EUR/USD exchange rate rises, indicating that more US Dollars are required to buy one Euro. Exchange rate fluctuations are central to Forex trading and impact profitability. For more details on exchange rates, visit the Forex page.

-

Bid and Ask Prices: In Forex trading, the bid price is the price at which you can sell a currency pair, while the ask price is the price at which you can buy it. The difference between these two prices is known as the spread. The spread represents the cost of trading and varies based on market conditions. A narrow spread generally indicates high liquidity, while a wider spread may suggest lower liquidity or higher volatility. For more on bid and ask prices and how they affect trading costs, visit the Forex page.

3. Major Currency Pairs

-

Major Pairs: Major currency pairs are the most actively traded in the Forex market and typically include the US Dollar. Examples include EUR/USD (Euro/US Dollar), USD/JPY (US Dollar/Japanese Yen), GBP/USD (British Pound/US Dollar), and USD/CHF (US Dollar/Swiss Franc). These pairs are characterized by high liquidity and tight spreads, making them popular among traders. To learn more about major currency pairs, visit the Forex page.

-

Cross Currency Pairs: Cross currency pairs involve two major currencies but exclude the US Dollar. Examples include EUR/GBP (Euro/British Pound) and EUR/JPY (Euro/Japanese Yen). These pairs offer opportunities to trade based on the relative strength of two major currencies without direct exposure to the US Dollar. Cross currency pairs can present unique trading opportunities and risks. For insights on cross currency pairs, check the Forex page.

-

Exotic Pairs: Exotic pairs consist of one major currency and one currency from a smaller or emerging economy, such as USD/TRY (US Dollar/Turkish Lira) or EUR/SEK (Euro/Swedish Krona). Exotic pairs often have wider spreads and can be more volatile due to lower liquidity and economic instability in the smaller economy. Trading exotic pairs requires understanding the specific economic conditions of the smaller economy. For more information on exotic currency pairs, visit the Forex page.

4. Trading Strategies and Tools

-

Technical Analysis: Technical analysis involves analyzing historical price data and using various indicators to forecast future price movements. Common tools include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). Technical analysis helps traders identify trends, potential entry and exit points, and market conditions. For more on technical analysis tools, visit the Trading Tools page.

-

Fundamental Analysis: Fundamental analysis examines economic indicators, geopolitical events, and other factors that impact currency values. Key indicators include interest rates, inflation rates, and employment figures. By analyzing these factors, traders can make informed predictions about currency movements based on economic conditions. For insights into fundamental analysis and economic indicators, explore the Trading Basics page.

-

Risk Management: Effective risk management is crucial for successful Forex trading. This includes setting stop-loss orders to limit potential losses, managing position sizes to avoid excessive risk, and using leverage wisely. Good risk management practices help protect your trading capital and mitigate potential losses. For more on managing risk and leverage, visit the Margin and Leverage page.

For further details on Forex trading strategies, tools, and market insights, visit 24markets.com and explore the resources available to enhance your trading experience.

Tags Directory

View AllLatest

View All

September 9, 2024

4 min

ETF Trading Strategies - 24markets.com

September 9, 2024

6 min

Building Confidence as a Trader - 24markets

September 9, 2024

3 min

Trading Strategies for Bonds

September 9, 2024

4 min

What is Position Sizing? - 24markets

Content

- - Overview of Forex

- - How Forex Trading Works

- - Major Currency Pairs

- - Trading Strategies and Tools