What Is Trading and Investing?

Discover the basics of trading and investing, their key differences, and how to get started. Learn about the benefits and risks involved, and how 24markets.com can help you achieve your financial goals.

Understanding the difference between trading and investing is crucial for anyone looking to participate in financial markets. Both approaches offer ways to grow wealth, but they involve different strategies, time horizons, and risk levels. This article explores the key aspects of trading and investing, their differences, and how to approach each based on your financial goals.

1. Definition of Trading

Overview

"What Is Trading" refers to the process of actively buying and selling financial instruments over short periods to profit from price fluctuations. Traders aim to capitalize on short-term movements and typically engage in frequent transactions. The primary goal is to generate returns through quick, often speculative trades.

Types of Trading

- Day Trading: Day traders buy and sell assets within the same trading day, closing all positions before the market closes to avoid overnight risk. This strategy requires significant time and attention. For more details on day trading strategies and tools, visit the trading tools section.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from short- to medium-term price movements. This approach balances between the rapid pace of day trading and the longer horizon of investing.

- Scalping: Scalpers make numerous trades throughout the day, focusing on small price changes to accumulate gains. This method requires precise timing and high-speed execution.

Tools and Strategies

- Technical Analysis: Traders often use charts, indicators, and patterns to make informed decisions. For more information on technical analysis tools, check out the basic technical analysis tools section.

- Algorithmic Trading: Some traders use automated systems to execute trades based on predefined criteria. These algorithms can process large volumes of data quickly, allowing for high-frequency trading.

2. Definition of Investing

Overview

Investing involves purchasing assets with the intention of holding them for the long term to achieve capital growth or income. Investors typically focus on the fundamentals of assets, such as company performance, economic conditions, and financial metrics, rather than short-term price movements.

Types of Investing

- Stocks: Investors buy shares of companies, aiming for long-term growth and dividends. For more information on stock investing, visit the stocks section.

- Bonds: Bonds are debt securities issued by governments or corporations, offering regular interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky compared to stocks.

- Real Estate: Investing in property can provide rental income and potential appreciation in value. Real estate investments can include residential, commercial, and industrial properties.

- Mutual Funds and ETFs: These funds pool money from multiple investors to invest in a diversified portfolio of assets. Mutual funds and exchange-traded funds (ETFs) offer a way to gain exposure to a broad range of securities with varying levels of risk.

Strategies and Goals

- Buy and Hold: This strategy involves purchasing assets and holding them for an extended period, regardless of market fluctuations. Investors aim to benefit from long-term growth and dividends.

- Value Investing: Value investors seek undervalued assets that they believe will increase in value over time. This approach requires thorough analysis of financial statements and market conditions.

- Growth Investing: Growth investors focus on assets that are expected to grow at an above-average rate. They prioritize potential for capital appreciation over current income.

3. Key Differences Between Trading and Investing

Time Horizon

- Trading: Short-term, often minutes to days.

- Investing: Long-term, often years.

Objectives

- Trading: Profit from price fluctuations and market inefficiencies.

- Investing: Achieve long-term growth and income.

Risk and Return

- Trading: Higher risk due to market volatility and frequent transactions. Potential for high returns.

- Investing: Generally lower risk due to diversified portfolios and long-term outlook. Returns accumulate over time.

Approach

- Trading: Focus on market trends, technical analysis, and short-term opportunities.

- Investing: Focus on asset fundamentals, economic conditions, and long-term growth potential.

Article by:

Jeremy Noble

Education Center Specialist 24markets.com

TAGS

Latest Education Articles

Show moreTake your trading to the next level.

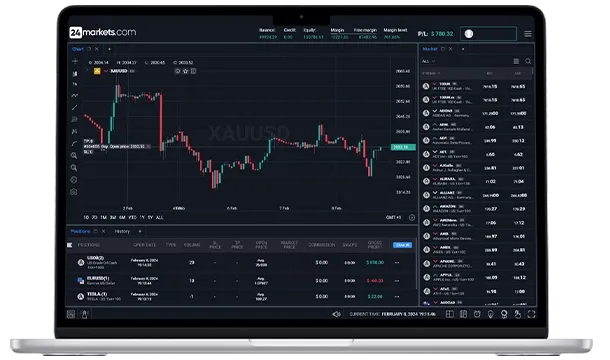

Join the broker built for global success in just 3 easy steps. A seamless experience built for traders who value speed and simplicity.

Create Your Account

Make Your First deposit