Master the Basics of

Tradings

At 24markets.com, we believe that trading should be approachable and inclusive for everyone. Whether you're just starting out or looking to strengthen your foundation, understanding the core principles is key to success. Explore the fundamentals and take your first step into the world of trading with confidence.

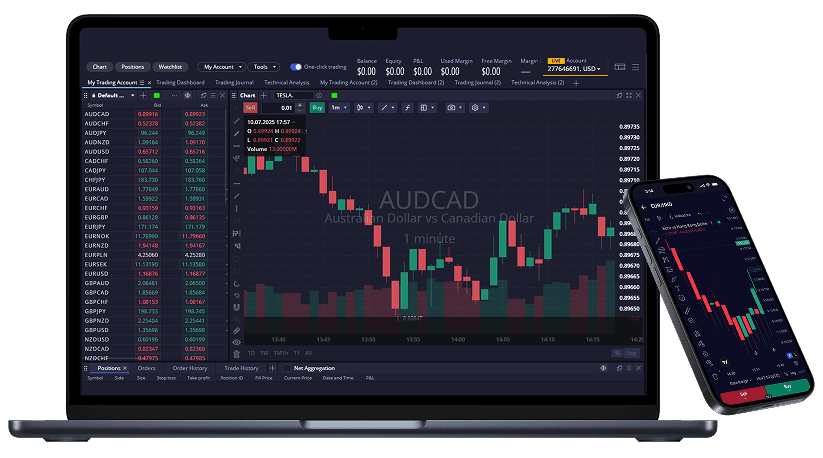

Build Confidence with a Demo Account

Before committing real capital, get hands-on experience with our risk-free demo account. Practice trading in real market conditions, explore various asset classes, and refine your strategy—all without financial pressure. It’s the perfect way to apply what you've learned, test new approaches, and build the confidence needed to transition into live trading.

What is Online Trading?

Stock trading involves buying and selling shares of publicly traded companies through stock exchanges. At 24markets.com, stock trading gives you the opportunity to profit from the rise or fall in the value of individual company stocks. For example, you might trade shares of a tech giant like Apple or a blue-chip stock like Coca-Cola. Buying a stock means you believe the company's value will increase over time. Stock prices can move due to earnings reports, market news, or economic trends—creating opportunities for both short-term traders and long-term investors.

Discover More

What is a CFD?

A Contract for Difference (CFD) is a financial instrument that lets traders speculate on the price movements of various assets without owning them. CFDs are commonly linked to stocks, currencies, commodities, indices, and bonds. Instead of purchasing the asset, traders agree to exchange the difference in its price from the opening to the closing of the contract. CFDs offer leverage, enabling greater market exposure with a smaller initial investment. This includes the ability to trade in both rising and falling markets. However, leverage also increases potential risk. It's essential to understand margin requirements, market behavior, and risk management techniques when trading CFDs on 24markets.com..

Discover More

Why Trade with Leverage?

Leverage in trading enables you to open larger positions using a fraction of the total trade value. This can potentially enhance your returns and diversify your trading portfolio. With leverage, you can also benefit from market downturns through short selling. Despite these advantages, leverage can magnify losses just as easily as gains. Traders must be aware of margin calls, manage position sizes carefully, and stay alert to market volatility. At 24markets.com, we recommend using leverage responsibly, supported by risk management tools and continuous market education.

Discover More

What Assets Can You Trade?

With 24markets.com, you can access a diverse range of global assets through CFD trading—all in one place. Choose from instruments such as:. • Stocks • Indices • Forex (Currencies) • Commodities • Cryptocurrencies Our all-in-one platform lets you trade multiple asset classes with the flexibility of a unified currency account. Forex, one of the most actively traded markets, is especially popular among online traders for its liquidity and 24-hour market cycle.

Discover More

How to Reduce Risk in Trading

Smart trading starts with strong risk management. Learn about different markets, diversify your portfolio, and use stop-loss and take-profit orders. Limit leverage until you're experienced, and stay updated on market trends. With 24markets.com, you can trade confidently using professional tools and a risk-free demo account. Stay disciplined and in control to protect your capital.

Start Investing

The Psychology of Successful Trading

Emotions like fear and greed can disrupt decision-making. Successful traders stay disciplined, follow their strategy, and manage psychological triggers. At 24markets.com, we provide tools and resources to help you build a resilient trading mindset for long-term success.

Learn More