What is a Stock?

A stock represents a share of ownership in a company and forms a fundamental part of the investment landscape. When you invest in stocks, you are buying a piece of the company, which can entitle you to various benefits, such as dividends and voting rights, and exposes you to potential risks. Here’s an in-depth look at what stocks are, how they work, and why they are important in investing.

Understanding Stocks

Definition of a Stock

A stock, also known as a share or equity, signifies ownership in a corporation. When you purchase stock, you become a shareholder and acquire a claim on the company's assets and earnings. This ownership provides you with rights to a portion of the company's profits, typically distributed as dividends, and allows you to vote on major corporate decisions. Stocks are traded on stock exchanges like the New York Stock Exchange (NYSE) and the NASDAQ, which facilitate the buying and selling of shares.

Types of Stocks

-

Common Stock: This type of stock represents ownership in a company and typically comes with voting rights at shareholder meetings. Common stockholders may receive dividends, although these payments are not guaranteed and can fluctuate based on the company's performance. The value of common stock can also vary widely, reflecting the company’s financial health and market conditions. For more on common stock, check out the forex section.

-

Preferred Stock: Preferred stockholders receive fixed dividends and have priority over common stockholders for dividend payments and in the event of liquidation. While preferred stock usually does not come with voting rights, it offers more stability in income. Preferred stocks are often preferred by investors seeking steady returns. For further details, visit the stocks section.

How Stocks Work

Issuance of Stocks

Companies issue stocks to raise capital for various purposes, such as funding expansion projects, investing in new technologies, or reducing existing debt. This process usually begins with an initial public offering (IPO), where a company offers its shares to the public for the first time. After the IPO, shares are listed on stock exchanges and can be bought and sold by investors.

Stock Trading

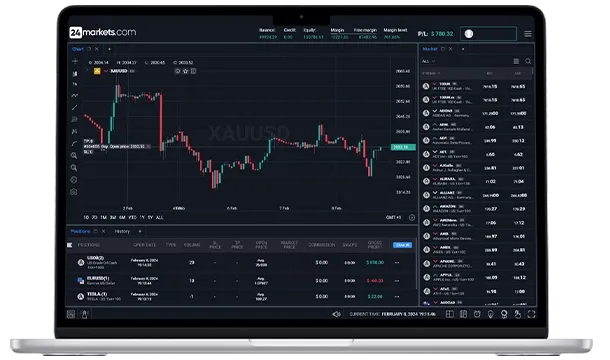

Once stocks are available on the market, they can be traded through brokerage accounts. Traders and investors place orders to buy or sell stocks, which are executed based on current market prices or specified limit prices. Various types of orders include market orders, limit orders, and stop orders. For more information on how these orders work, explore the trading tools section.

Stock Prices

Stock prices fluctuate based on supply and demand dynamics, company performance, and broader market conditions. Factors such as earnings reports, economic indicators, and geopolitical events can influence stock prices. For a better understanding of market dynamics, you can check out the fundamentals of trading section.

Why Invest in Stocks?

Potential for Capital Appreciation

Investing in stocks offers the potential for significant capital gains. As companies grow and their profitability increases, the value of their stocks can rise, leading to potential returns for investors. This growth potential is one of the primary reasons investors are attracted to the stock market. For strategies on long-term investing, refer to the forex section.

Dividends

Many companies distribute dividends to their shareholders as a way to share profits. Dividends are typically paid on a quarterly basis and provide a steady income stream. For those seeking regular income from their investments, dividend-paying stocks can be an attractive option. Learn more about dividend stocks in the stocks section.

Ownership and Voting Rights

Owning stocks grants shareholders a voice in the company’s decisions. This includes voting on matters such as mergers and acquisitions, changes to corporate governance, and board elections. Voting rights can influence the company’s strategic direction, making stock ownership more engaging for investors.

Risks of Investing in Stocks

Market Volatility

Stock prices can be highly volatile, reflecting changes in market sentiment, economic conditions, and company performance. This volatility can result in significant fluctuations in the value of investments. Managing this risk requires understanding market trends and implementing effective risk management strategies. For more on managing risk, explore the risk management strategies section.

Company-Specific Risks

Investing in individual stocks exposes investors to risks associated with specific companies. Factors such as poor financial performance, management issues, or industry disruptions can negatively impact stock values. Conducting thorough fundamental analysis helps in evaluating a company’s financial health and making informed investment decisions.

Economic and Political Risks

Broader economic and political events can affect stock prices. Changes in interest rates, inflation, or geopolitical tensions can influence market conditions and impact stock performance. Understanding these macroeconomic factors is essential for anticipating their potential effects on investments. For insights on economic indicators, visit the economic indicators section.

Getting Started with Stock Investment

To start investing in stocks, you need to open a brokerage account. Choose a brokerage firm that provides access to various stock markets, offers a range of investment tools, and has competitive fees. Consider factors such as trading platforms, customer support, and account types when selecting a broker. For a list of brokers and trading platforms, check out the trading tools section.

Tags Directory

View AllLatest

View All

September 9, 2024

4 min

ETF Trading Strategies - 24markets.com

September 9, 2024

6 min

Building Confidence as a Trader - 24markets

September 9, 2024

3 min

Trading Strategies for Bonds

September 9, 2024

4 min

What is Position Sizing? - 24markets

Content

- - Understanding Stocks

- - How Stocks Work

- - Why Invest in Stocks?

- - Risks of Investing in Stocks

- - Getting Started with Stock Investment