Exploring Types of Financial Markets: Stock, Forex, Commodity, and More

Delve into the various types of financial markets. Learn about stocks, forex, commodities, bonds, and derivatives, their characteristics, and how they impact global economies.

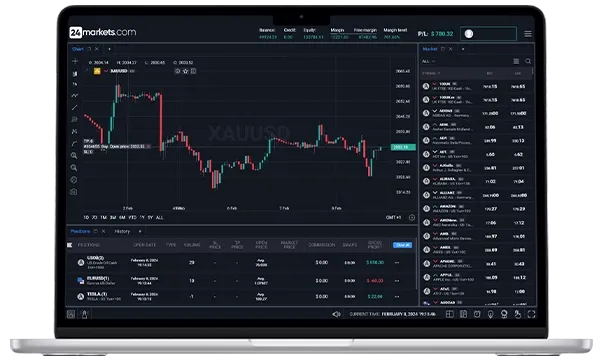

Financial markets serve as platforms where investors and traders engage in buying and selling financial instruments, facilitating the flow of capital and investments. Each type of financial market offers unique opportunities and operates under different mechanisms. This article provides a comprehensive overview of major financial markets, including stock, forex, commodity, bond, derivatives, and cryptocurrency markets.

1. Stock Markets

Overview

Stock markets are venues where shares of publicly listed companies are traded. They play a crucial role in the economy by enabling companies to raise capital and offering investors the opportunity to participate in a company's financial growth and profit distribution. Stock markets operate through exchanges, where securities are listed and traded.

Key Features

- Major Exchanges: Prominent stock exchanges include the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a platform for buying and selling stocks and ensure regulatory compliance and transparency in trading.

- Stock Types: Stocks are categorized into common and preferred stocks. Common stocks provide shareholders with voting rights and potential dividends, while preferred stocks offer fixed dividends and priority over common stockholders in the event of liquidation.

Investment Opportunities

Investors can engage in various strategies such as value investing, growth investing, and dividend investing to achieve their financial objectives. For more on investment strategies in stocks, refer to the stocks section.

Example: If you're interested in growth stocks, researching companies with high potential for future earnings can offer substantial returns. Conversely, dividend stocks provide regular income through dividends.

2. Forex Markets

Overview

The forex (foreign exchange) market is the global platform for trading currencies. It is the largest and most liquid financial market, with a daily trading volume exceeding $6 trillion. Forex trading involves buying one currency while selling another, and it operates continuously across different time zones.

Key Features

- Currency Pairs: Forex trading involves currency pairs such as EUR/USD (Euro/US Dollar) and GBP/JPY (British Pound/Japanese Yen). Each pair consists of a base currency and a quote currency, and traders speculate on the exchange rate movements between them.

- Market Structure: Unlike centralized exchanges, the forex market is decentralized, operating through a network of banks, brokers, and financial institutions. It functions via electronic trading platforms, allowing traders to access real-time market data and execute trades.

Trading Strategies

Forex traders use technical analysis, fundamental analysis, and algorithmic trading strategies to make informed decisions. For a detailed guide on forex trading strategies, visit the forex section.

Example: Traders might use technical indicators such as moving averages and RSI (Relative Strength Index) to identify potential entry and exit points in the forex market.

3. Commodity Markets

Overview

Commodity markets facilitate the trading of raw materials and primary agricultural products. These markets are essential for various industries, as commodities serve as inputs for production processes. Commodity trading can be done through physical delivery or via futures contracts.

Key Features

- Types of Commodities: Commodities are classified into hard commodities (e.g., crude oil, gold) and soft commodities (e.g., wheat, coffee). Hard commodities are typically extracted or mined, while soft commodities are grown or produced.

- Exchanges: Commodity trading occurs on specialized exchanges like the Chicago Mercantile Exchange (CME) and the London Metal Exchange (LME). These exchanges provide a marketplace for futures contracts and options.

Investment Opportunities

Investors can gain exposure to commodities through futures contracts, options, and commodity-focused ETFs (Exchange-Traded Funds). For more information on commodity trading, refer to the commodities section.

Example: Commodity traders might use futures contracts to hedge against price fluctuations in oil or agricultural products, or to speculate on price movements.

4. Bond Markets

Overview

Bond markets involve the trading of debt securities issued by corporations, municipalities, and governments. Bonds represent loans made by investors to the issuer, who in return provides periodic interest payments and repays the principal at maturity.

Key Features

- Bond Types: Bonds come in various forms, including government bonds (e.g., U.S. Treasury bonds), corporate bonds, and municipal bonds. Government bonds are considered low-risk, while corporate bonds offer higher yields but come with higher risk.

- Yield and Price: The price of bonds moves inversely with interest rates. When interest rates rise, bond prices generally fall, and when rates fall, bond prices rise.

Investment Opportunities

Investors can purchase bonds directly or invest in bond mutual funds and ETFs. For insights into bond investing, refer to the forex section for related bond market information.

Example: Long-term bonds might offer higher yields compared to short-term bonds, but they also come with greater interest rate risk.

5. Derivatives Markets

Overview

Derivatives markets involve financial contracts that derive their value from an underlying asset, such as stocks, bonds, or commodities. Common derivatives include futures contracts, options, and swaps. Derivatives can be used for hedging, speculation, or arbitrage.

Key Features

- Futures Contracts: These are agreements to buy or sell an asset at a predetermined price at a future date. Futures are used to hedge against price changes or speculate on price movements.

- Options: Options provide the right, but not the obligation, to buy or sell an asset at a specified price within a certain period. Options can be used to manage risk or leverage trading positions.

Trading Strategies

Derivatives trading requires a solid understanding of the underlying assets and market conditions. For detailed information on trading derivatives, visit the trading tools section.

Example: Traders might use options strategies like covered calls or protective puts to manage risk and enhance returns in their portfolios.

6. Cryptocurrency Markets

Overview

Cryptocurrency markets involve the trading of digital assets that use cryptography for security. These markets have grown significantly with the rise of cryptocurrencies like Bitcoin and Ethereum, offering a new avenue for investment and trading.

Key Features

- Digital Assets: Cryptocurrencies operate on blockchain technology, providing a decentralized and secure method for transactions. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- Exchanges: Digital assets are traded on cryptocurrency exchanges such as Binance and Coinbase. These platforms offer a marketplace for buying, selling, and trading cryptocurrencies.

Investment Opportunities

Investors can trade cryptocurrencies through exchanges or invest in cryptocurrency-focused funds and ETFs. For more details on cryptocurrency markets, explore the crypto section.

Example: Investors might diversify their portfolios by including cryptocurrencies like Bitcoin or Ethereum, or by investing in blockchain-related projects.

TAGS

Latest Education Articles

Show more

Earnings Reports and Equity CFDs

Trend vs. Range Strategies

Trading Breakouts vs. Pullbacks

Hedging Basics for Intermediate Traders

Take your trading to the next level.

Join the broker built for global success in just 3 easy steps. A seamless experience built for traders who value speed and simplicity.

Create Your Account

Make Your First deposit