Key Economic Indicators: GDP, Inflation, Employment Rates

Economic indicators provide crucial insights into the health and performance of an economy. Key indicators such as Gross Domestic Product (GDP), inflation rates, and employment rates are essential for making informed trading and investment decisions. This guide delves into these indicators, exploring their definitions, significance, and impact on various financial markets.

1. Gross Domestic Product (GDP)

Gross Domestic Product (GDP) represents the total monetary value of all finished goods and services produced within a country over a specific period, usually annually or quarterly. It is a broad measure of economic activity and health.

-

Types of GDP:

- Nominal GDP: Measures the value of economic output as priced at current market prices. It does not account for inflation.

- Real GDP: Adjusts nominal GDP for inflation, providing a more accurate representation of economic growth by reflecting the value of goods and services at constant prices.

- GDP Growth Rate: Represents the percentage increase or decrease in GDP from one period to another, indicating economic expansion or contraction.

-

Significance: GDP is a key indicator of economic performance. A rising GDP typically signifies a growing economy, increased consumer and business spending, and higher investment. Conversely, a declining GDP may indicate economic troubles and reduced economic activity.

-

Impact on Markets:

- Stock Market: Positive GDP growth often leads to increased corporate profits and higher stock prices as businesses benefit from a robust economy. For more on how GDP influences stock market performance, visit stocks. A strong GDP can also boost investor confidence, leading to increased market participation.

- Forex Market: Strong GDP growth can attract foreign investment, leading to a stronger national currency. Conversely, a shrinking GDP may weaken the currency as investor confidence declines. Learn more about how GDP affects currency values on forex.

- Commodities Market: Rising GDP generally boosts demand for raw materials and commodities, as economic expansion increases industrial production and consumer spending. For insights into GDP’s impact on commodity prices, check out commodities.

- Stock Market: Positive GDP growth often leads to increased corporate profits and higher stock prices as businesses benefit from a robust economy. For more on how GDP influences stock market performance, visit stocks. A strong GDP can also boost investor confidence, leading to increased market participation.

2. Inflation Rates

Inflation measures the rate at which the general level of prices for goods and services rises, eroding purchasing power. The Consumer Price Index (CPI) and the Producer Price Index (PPI) are commonly used to measure inflation.

-

Types of Inflation:

- Consumer Price Index (CPI): Measures changes in the price level of a basket of consumer goods and services. It is a primary indicator of cost-of-living changes.

- Producer Price Index (PPI): Tracks changes in the selling prices received by domestic producers for their output. It provides insight into inflation at the wholesale level.

-

Significance: Moderate inflation is often a sign of economic growth, while high inflation can erode consumer purchasing power and reduce economic stability. Hyperinflation or deflation can indicate severe economic issues.

-

Impact on Markets:

- Stock Market: High inflation can lead to increased costs for businesses and reduced consumer spending, potentially resulting in lower stock prices. Conversely, low inflation can be favorable for stock markets as it may signal stable economic conditions. For more on inflation's effect on the stock market, visit stocks.

- Forex Market: Central banks often respond to inflation with monetary policy adjustments. Higher inflation may lead to higher interest rates, which can strengthen the currency. However, excessive inflation can devalue the currency. Learn more about how inflation affects forex on forex.

- Commodities Market: Inflation can drive up commodity prices as investors seek assets to hedge against rising prices. For detailed information on inflation’s impact on commodities, visit commodities.

- Stock Market: High inflation can lead to increased costs for businesses and reduced consumer spending, potentially resulting in lower stock prices. Conversely, low inflation can be favorable for stock markets as it may signal stable economic conditions. For more on inflation's effect on the stock market, visit stocks.

3. Employment Rates

Employment Rates measure the percentage of the labor force that is currently employed. Key metrics include the unemployment rate and job creation figures.

-

Key Employment Metrics:

- Unemployment Rate: Represents the percentage of the labor force that is unemployed and actively seeking employment. It is a lagging indicator that reflects economic conditions.

- Job Creation: Tracks the number of new jobs created in the economy over a specific period. Strong job creation often indicates economic growth and stability.

-

Significance: High employment rates generally indicate a healthy economy with strong consumer spending and economic stability. Rising unemployment can signal economic weakness and reduced consumer confidence.

-

Impact on Markets:

- Stock Market: Low unemployment and strong job creation can boost investor confidence and drive stock market performance. High unemployment may signal economic challenges and result in lower stock prices. For more on how employment rates affect stocks, visit stocks.

- Forex Market: Strong employment data can lead to expectations of higher interest rates, potentially strengthening the currency. Conversely, weak employment data may weaken the currency. Learn more about employment rates and their influence on forex at forex.

- Commodities Market: Employment growth can lead to increased consumer demand for goods and services, impacting commodity prices. For insights into how employment rates affect commodities, check out commodities.

- Stock Market: Low unemployment and strong job creation can boost investor confidence and drive stock market performance. High unemployment may signal economic challenges and result in lower stock prices. For more on how employment rates affect stocks, visit stocks.

4. How to Utilize Economic Indicators in Your Trading Strategy

Incorporating economic indicators into your trading strategy can enhance your market analysis and decision-making:

- Monitor Regularly: Keep up with economic reports and announcements related to GDP, inflation, and employment rates to stay informed about economic trends.

- Analyze Historical Data: Review historical data and trends for these indicators to understand their typical impact on financial markets and anticipate future movements.

- Combine with Technical Analysis: Use economic indicators in conjunction with technical analysis tools, such as charts and patterns, to gain a comprehensive view of market conditions and make informed trading decisions.

5. Additional Resources

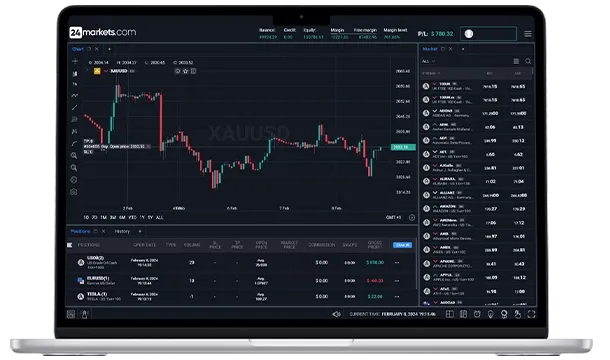

For further insights into how economic indicators affect financial markets, visit 24markets.com. Their extensive resources provide valuable information on trading strategies, market analysis, and more.

By understanding and effectively utilizing economic indicators like GDP, inflation, and employment rates, you can enhance your trading strategy and navigate market fluctuations with greater confidence.

Content

- - Gross Domestic Product (GDP)

- - Inflation Rates

- - Employment Rates

- - How to Utilize Economic Indicators in Your Trading Strategy

- - Additional Resources