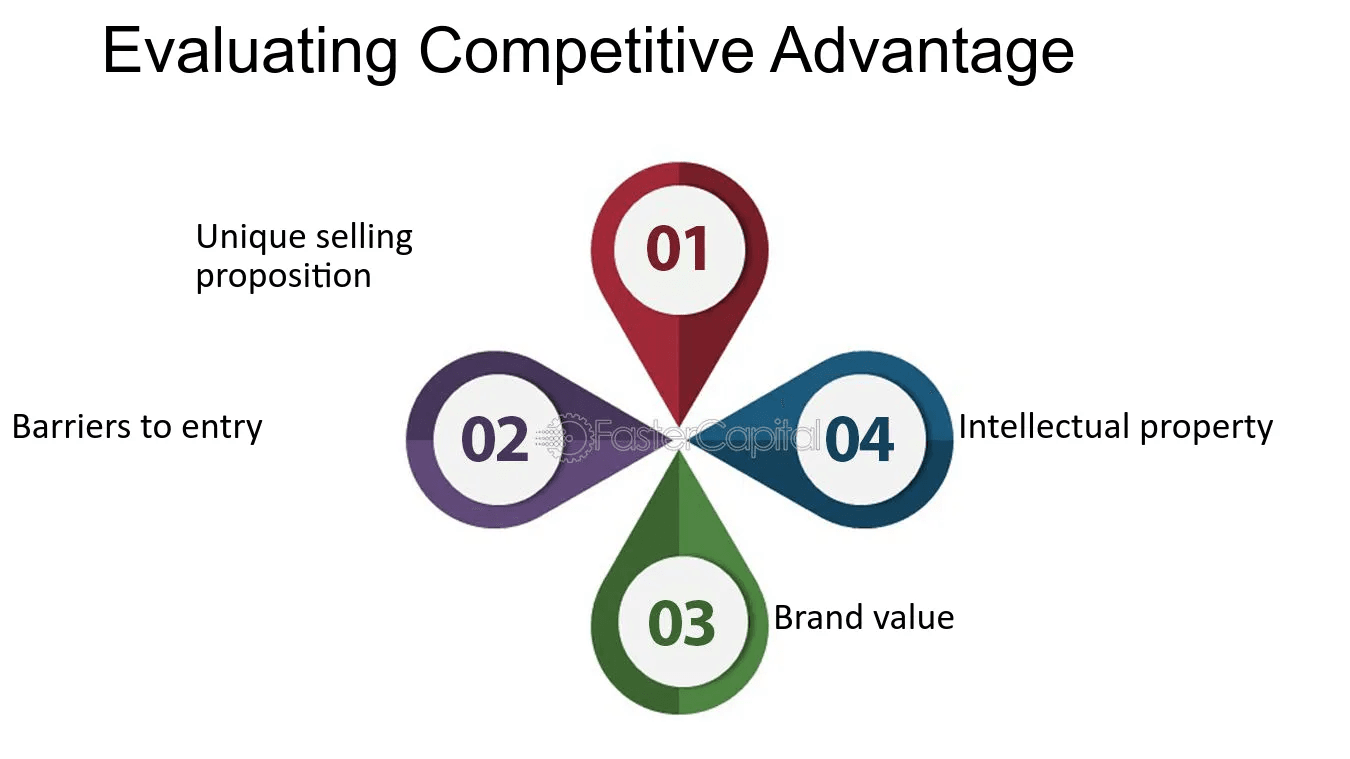

Evaluating Competitive Advantage (Moat)

Discover how to evaluate a company's competitive advantage, or "moat," to identify strong investment opportunities.

Understanding a company’s competitive advantage, often referred to as its "moat," is essential for investors aiming to identify businesses with the potential for long-term success and profitability. A competitive advantage allows a company to protect its market position and generate sustainable returns. This guide delves into the concept of moats, different types of competitive advantages, methods for evaluating them, and their significance in investment decisions.

What is a Competitive Advantage (Moat)?

A competitive advantage, or economic moat, is a distinctive feature that allows a company to outperform its competitors. It acts as a barrier to entry, preventing other businesses from eroding the company’s market share and profitability. This moat ensures that the company can sustain its competitive edge over the long term, even in the face of market challenges and evolving industry dynamics.

Types of Competitive Advantages

-

Cost Advantage: Companies with a cost advantage can produce goods or services at a lower cost than their competitors, allowing them to offer lower prices or enjoy higher profit margins.

Example: A technology company that develops a more efficient manufacturing process can reduce production costs, providing a cost advantage. Learn more about cost analysis in commodities trading.

-

Differentiation Advantage: Firms with a differentiation advantage offer unique products or services that justify premium pricing. This uniqueness can stem from superior quality, features, or brand reputation.

Example: A luxury car manufacturer that offers innovative designs and high-performance vehicles enjoys a differentiation advantage. Explore more about differentiation strategies in stock trading.

-

Network Effect: Companies that benefit from the network effect see their products or services become more valuable as more people use them. This creates a self-reinforcing cycle of growth and market dominance.

Example: Social media platforms often benefit from the network effect, where the value of the platform increases with the number of users. For more insights on digital market dynamics, visit crypto trading.

-

Switching Costs: Businesses with high switching costs make it difficult or costly for customers to switch to a competitor. This locks in customers and protects the company’s market share.

Example: A software company that requires extensive customization for its products may create high switching costs, deterring customers from changing providers. Discover more about investment planning and technology integration at Investment Planning.

-

Intellectual Property: Companies with strong intellectual property, such as patents and copyrights, can prevent competitors from imitating their products or services, maintaining their market position.

Example: Pharmaceutical companies often rely on patents to protect their drug formulations, ensuring exclusive sales for a period. For details on intellectual property rights and their financial impact, see CFD Trading.

-

Brand Equity: A strong brand can significantly enhance a company's market position, enabling it to attract and retain customers, and to charge premium prices for its products or services.

Example: An iconic global beverage company that has built its brand on consistent quality and innovation can leverage its brand equity for market leadership. Learn more about branding in the context of trading tools.

Evaluating Competitive Advantages

Analyzing Financial Statements

Financial statements provide crucial insights into a company’s competitive advantage. By examining key metrics such as gross margin, operating margin, and return on equity, investors can gauge the effectiveness of a company’s moat.

Example: A consistently high gross margin might indicate a strong cost or differentiation advantage, as the company can charge premium prices or produce at lower costs. For a comprehensive understanding of financial statement analysis, refer to Fundamentals of Trading.

Assessing Market Position

Understanding a company’s market position involves analyzing its market share, customer base, and industry trends. A dominant market position often reflects a robust competitive advantage.

Example: A company with a large and loyal customer base that is difficult to replicate likely has a substantial network effect or high switching costs. Explore more about market position analysis in forex trading.

Evaluating Brand Strength

A strong brand can be a powerful competitive advantage, enabling companies to command premium pricing and foster customer loyalty. Brand strength can be assessed through customer surveys, brand recognition studies, and market analysis.

Example: A global beverage company with a well-known brand and a reputation for quality may enjoy a significant differentiation advantage. Learn more about branding strategies in copytrading.

Reviewing Patents and Trademarks

A company’s patent portfolio and trademarks are essential indicators of its intellectual property advantage. Investors should review the scope and duration of these protections to assess the company’s ability to fend off competition.

Example: A technology company with a broad patent portfolio covering core innovations in its industry has a strong intellectual property moat. For insights into evaluating intellectual property assets, see Metatrader 5.

Monitoring Customer Loyalty and Retention Rates

Customer loyalty and retention rates are critical indicators of a company’s ability to maintain its competitive advantage. High retention rates suggest that customers see significant value in the company’s offerings and are less likely to switch to competitors.

Example: A telecom company that retains a large percentage of its customer base despite the availability of cheaper alternatives likely has high switching costs or a superior customer service experience. For strategies on customer retention in trading, visit Introducing Broker (IB).

Competitive Analysis

Conducting a competitive analysis involves comparing a company’s performance, market share, and strategic positioning against its competitors. This analysis helps identify the company’s strengths and weaknesses relative to others in the industry.

Example: An automotive company that consistently outperforms its competitors in terms of innovation and customer satisfaction demonstrates a strong competitive advantage. Learn more about competitive analysis techniques at Trading Tools.

Importance of Competitive Advantage in Investment Decisions

Investing in companies with a sustainable competitive advantage can lead to superior returns over the long term. A strong moat not only protects the company from competitors but also provides pricing power, leading to higher profitability and market resilience.

Long-Term Profitability

Companies with a competitive advantage can maintain higher profit margins and reinvest profits into research, development, and expansion, further strengthening their moat.

Example: A healthcare company with patented medical devices that are difficult to replicate can sustain high profitability and market share. For more on long-term profitability strategies, visit Introducing Broker (IB).

Resilience to Market Changes

Firms with robust moats are better equipped to navigate market volatility and economic downturns. Their competitive advantages provide a buffer against external pressures, ensuring stable financial performance.

Example: A retail company with a loyal customer base and unique product offerings can withstand market fluctuations more effectively. Discover strategies for market resilience at Trading Tools.

Competitive Advantage and Investor Confidence

A sustainable competitive advantage can boost investor confidence, leading to higher stock prices and easier access to capital. Investors are more likely to invest in companies they believe can maintain their market position and profitability over time.

Example: A technology company with a dominant market position in an emerging industry is likely to attract more investment due to its perceived competitive advantage. For insights into how competitive advantages influence investment decisions, see Account Types.

Conclusion

Evaluating a company’s competitive advantage is a critical component of investment analysis. By understanding the different types of moats and assessing their impact on financial performance and market position, investors can make informed decisions and identify businesses with the potential for long-term success. For further insights into competitive advantage and investment strategies, explore resources on stocks, forex, and commodities.

TAGS

Latest Education Articles

Show more

Earnings Reports and Equity CFDs

Trend vs. Range Strategies

Trading Breakouts vs. Pullbacks

Hedging Basics for Intermediate Traders

Take your trading to the next level.

Join the broker built for global success in just 3 easy steps. A seamless experience built for traders who value speed and simplicity.

Create Your Account

Make Your First deposit