Common Emotional Pitfalls: Fear, Greed, Overconfidence

Emotions play a significant role in trading and can greatly impact your decision-making process. Understanding and managing these emotional pitfalls—fear, greed, and overconfidence—are crucial for successful trading. Here’s an in-depth look at these common emotional challenges and strategies to overcome them.

1. Fear

Fear is a powerful emotion that can lead to irrational decision-making and affect your trading performance. In trading, fear often manifests as anxiety about potential losses or market volatility.

- Fear of Loss: This common fear occurs when traders are overly concerned about losing money, which can lead to hesitation in making trades or prematurely closing positions. To mitigate this, it’s essential to develop a robust trading strategy that includes clear risk management rules.

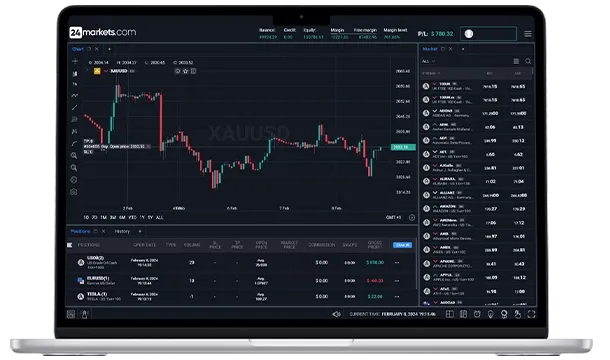

- Fear of Missing Out (FOMO): FOMO happens when traders worry about missing out on potential profits, leading to impulsive trades based on emotion rather than analysis. To address FOMO, stick to your trading plan and avoid decisions driven by short-term market movements. For tips on managing fear and developing a sound approach, explore trading tools at 24markets.com.

2. Greed

Greed can drive traders to take excessive risks in pursuit of higher returns. This emotion can lead to poor decision-making and significant losses.

- Pursuit of Higher Returns: Greed often results in traders seeking to maximize profits beyond their planned strategy, which can lead to overleveraging and high-risk trades. To control greed, establish realistic profit targets and adhere to your trading plan. For more on setting achievable targets and managing risk, visit trading basics.

- Overleveraging: To achieve greater returns, traders might use excessive leverage, increasing both potential profits and losses. Understand the risks associated with leverage and use it judiciously. Learn more about managing leverage and its effects on your trades.

3. Overconfidence

Overconfidence can lead to poor trading decisions as traders may believe they are infallible or possess superior knowledge.

- Overestimating Abilities: Overconfident traders might believe they can predict market movements with high accuracy, leading to risky trades. This can result in significant losses. To counteract overconfidence, regularly review and assess your trading performance and decisions. For tools and resources to help with performance analysis, check out trading tools.

- Ignoring Risk Management: Overconfident traders might neglect risk management strategies, believing they can handle any losses. Always implement risk management practices to protect your capital. Learn about effective risk management strategies to safeguard your investments.

Strategies to Overcome Emotional Pitfalls

-

Develop a Trading Plan: A well-defined trading plan helps you make objective decisions and reduces the impact of emotions. Ensure your plan includes specific rules for entry, exit, and risk management. For assistance in creating a solid trading plan, visit trading strategies.

-

Practice Mindfulness: Techniques such as mindfulness and meditation can help you manage stress and improve emotional control. Incorporate mindfulness practices into your daily routine to maintain focus and reduce emotional reactions.

-

Use Automated Trading Systems: Automated trading systems can help remove emotions from the trading process by executing trades based on pre-set criteria. Explore options for automated trading systems at 24markets.com to see how they can enhance your trading efficiency.

-

Regularly Review Performance: Regularly reviewing your trading performance can help you identify emotional biases and improve your decision-making process. Utilize performance analysis tools to assess your trades and strategies. For tools and resources on performance review, check trading tools.

By understanding and managing these emotional pitfalls, you can enhance your trading performance and make more informed decisions. For more insights and resources on effective trading practices, explore 24markets.com for comprehensive support and tools.

Content

- - Fear

- - Greed

- - Overconfidence

- - Strategies to Overcome Emotional Pitfalls