How to Place a Market Order

Placing a market order is one of the most fundamental trading actions you can perform. A market order instructs your broker to buy or sell a security immediately at the best available price. Learn how to place a market order while minimizing slippage. Discover key steps and considerations for executing trades quickly and efficiently in volatile markets.

1. Understanding Market Orders

A market order is designed to be executed as quickly as possible at the current market price. It is the simplest type of order, but it is essential to understand its features and implications.

- Definition: A market order is an order to buy or sell a security immediately at the best available price. This order type ensures fast execution but does not guarantee the price at which the order will be executed. For a deeper understanding of market orders, check out trading basics.

- Advantages: The primary advantage of a market order is its speed of execution. This is ideal for traders who need to enter or exit positions quickly. Learn more about the benefits of quick execution on trading tools.

- Disadvantages: The main drawback is that the execution price may differ from the expected price, especially in volatile markets. This can result in slippage. For more on slippage and its impact, visit trading strategies.

2. Steps to Place a Market Order

Follow these steps to place a market order through your trading platform:

-

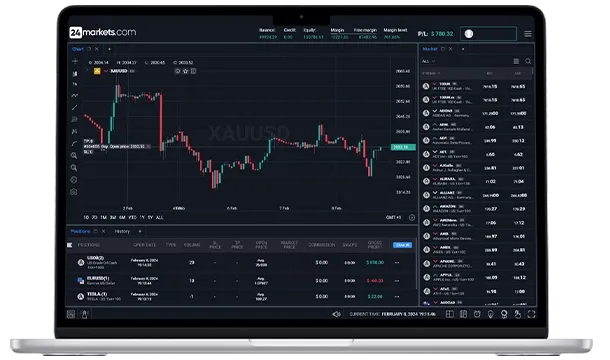

Step 1: Access Your Trading Platform

Log in to your trading account using your preferred trading platform. Ensure that you have access to the asset you wish to trade. For guidance on navigating trading platforms, visit trading basics. -

Step 2: Select the Security

Choose the security (such as a stock, forex pair, or commodity) you want to trade. Enter the symbol or name of the security in the search bar of your trading platform. For a list of available trading assets, check out forex and stocks. -

Step 3: Choose the Order Type

Select "Market Order" from the available order types. This option is usually found in the order entry section of your trading platform. For details on different order types, visit trading tools. -

Step 4: Enter the Order Details

Input the quantity of the security you wish to buy or sell. Ensure that you specify the number of shares, lots, or contracts based on the security being traded. For more on specifying order details, explore trading strategies. -

Step 5: Review and Confirm

Review the order details to ensure accuracy, including the quantity and security symbol. Confirm the order by clicking the "Submit" or "Place Order" button. This will execute your market order at the current best available price.

3. Considerations When Placing a Market Order

While market orders are straightforward, several factors should be considered to optimize their effectiveness:

- Liquidity: Ensure that the security you are trading is liquid enough to handle market orders without significant price slippage. Highly liquid markets, such as major forex pairs, are ideal for market orders. Learn more about liquidity and its importance on forex.

- Volatility: Be aware of market volatility, as it can impact the execution price of your market order. High volatility may lead to slippage and unexpected execution prices. For tips on trading in volatile markets, visit trading strategies.

- Market Hours: Ensure that you are placing market orders during regular market hours to avoid execution issues. Some markets may have extended or restricted trading hours. For information on market hours, check out trading basics.

4. Examples of Market Orders

To illustrate how market orders work, here are a few examples:

- Example 1: If you want to buy 100 shares of Company XYZ immediately, you would place a market order to buy 100 shares of XYZ. Your order will be executed at the best available price in the market at the time of order placement.

- Example 2: If you need to sell 50 contracts of a commodity futures contract quickly, a market order will sell the contracts at the best available price. This ensures a quick exit from the position.

5. When to Use Market Orders

Market orders are best used when speed is essential and price is less of a concern. They are suitable for:

- Quick Entries and Exits: When you need to enter or exit a position swiftly, especially in fast-moving markets.

- Highly Liquid Markets: When trading assets with high liquidity, where the impact of slippage is minimal.

- Emergency Situations: When immediate execution is required, such as in news-driven market events.

Understanding how to place a market order effectively is a fundamental skill for any trader. By following these steps and considering the factors involved, you can execute trades efficiently and manage your trading strategy effectively. For more information on market orders and trading techniques, explore 24markets.com.

Content

- - Understanding Market Orders

- - Steps to Place a Market Order

- - Considerations When Placing a Market Order

- - Examples of Market Orders

- - When to Use Market Orders