How to Open a Trading Account: A Step-by-Step Guide

Learn how to open a trading account with this comprehensive guide. Discover the steps to choose a broker, complete the application form, verify your identity, fund your account, and start trading with 24markets.com.

Learn how to open a trading account with this comprehensive guide. Discover the steps to choose a broker, complete the application form, verify your identity, fund your account, and start trading.

The first step in opening a trading account is selecting a reputable broker that meets your trading needs. Here’s what to consider:

- Broker Reputation: Research brokers to ensure they are well-regulated and have a good track record. Look for reviews and ratings from other traders.

- Regulation: Ensure the broker is regulated by a reputable authority. For instance, 24markets.com is regulated and offers a range of trading services.

- Trading Platform: Evaluate the trading platforms offered by the broker. A good platform should be user-friendly, reliable, and equipped with necessary trading tools. The 24markets Webtrader is an example of a comprehensive trading platform with advanced features.

2. Select the Right Account Type

Different brokers offer various account types. Choose one that aligns with your trading style and financial goals:

- Standard Accounts: Ideal for beginners, offering basic features and lower minimum deposits. Check out the Account Types page on 24markets.com for more details.

- Margin Accounts: Allow you to trade with borrowed funds, increasing your potential returns but also your risk. Learn more about margin requirements on the Margin Trading page.

- Professional Accounts: Designed for experienced traders, often providing access to higher leverage and advanced trading tools. Review the 24markets Professional Account options for insights.

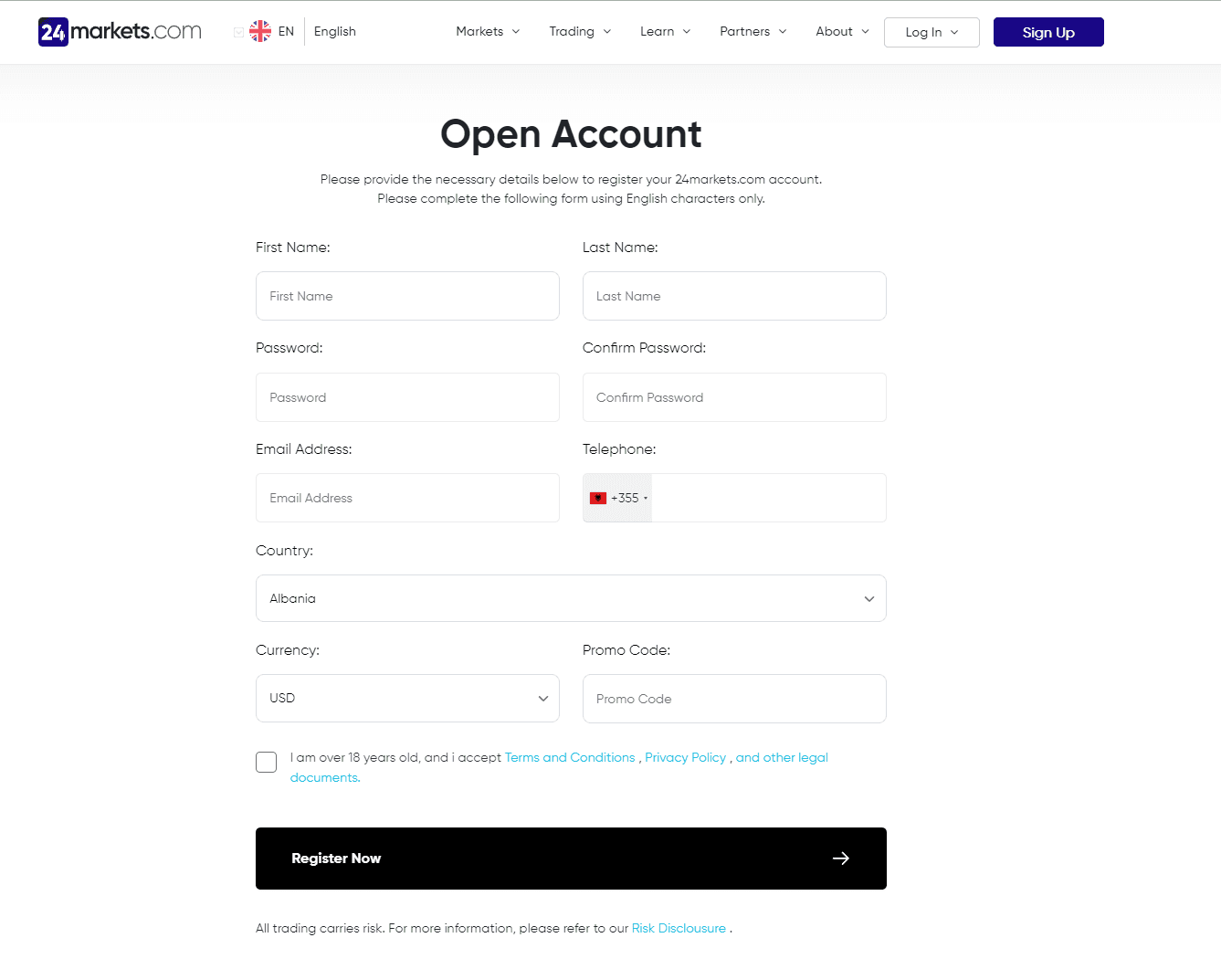

3. Complete the Application Process

Once you’ve chosen a broker and account type, you’ll need to complete the application process:

- Provide Personal Information: You will need to submit personal details such as your name, address, date of birth, and social security number. This information is used to verify your identity and comply with regulatory requirements.

- Submit Identification Documents: Brokers typically require identification documents to verify your identity. Common documents include a passport, driver’s license, and utility bills. For guidance on document submission, refer to the 24markets FAQ.

- Account Verification: After submitting your documents, the broker will verify them. This process can take a few hours to a few days. You’ll receive a confirmation email once your account is approved.

4. Fund Your Trading Account

After your account is verified, you’ll need to deposit funds to start trading:

- Deposit Methods: Brokers usually offer several deposit methods, including bank transfers, credit/debit cards, and online payment systems. For example, 24markets.com supports various payment methods for convenience.

- Minimum Deposit: Check the minimum deposit requirements for your chosen account type. Ensure you meet these requirements to activate your account.

- Deposit Process: Follow the broker’s instructions to make your deposit. Monitor your account to confirm that the funds have been credited.

5. Set Up Your Trading Platform

With your account funded, it’s time to set up your trading platform:

- Download and Install: Download the trading platform software from the broker’s website. For instance, 24markets.com offers platforms like the Webtrader that can be accessed directly through your browser.

- Configure Settings: Customize your trading platform settings to suit your preferences. This includes setting up charts, indicators, and watchlists.

- Practice Using a Demo Account: Before trading with real money, use a demo account to familiarize yourself with the platform’s features and functions. The 24markets Demo Account is an excellent way to practice and build confidence.

6. Develop a Trading Strategy

A well-thought-out trading strategy is essential for success:

- Define Your Goals: Set clear trading goals based on your financial objectives, risk tolerance, and time commitment.

- Choose a Trading Style: Decide on a trading style that suits you, such as day trading, swing trading, or long-term investing. Each style has its own strategies and time frames.

- Create a Trading Plan: Develop a trading plan outlining your entry and exit strategies, risk management rules, and criteria for selecting trades.

7. Monitor and Manage Your Trades

Effective trade management is key to successful trading:

- Track Performance: Regularly review your trades and performance to identify what’s working and what needs improvement. Use performance tracking tools available on platforms like 24markets Webtrader.

- Adjust Strategies: Based on your performance review, adjust your trading strategies as needed to adapt to changing market conditions.

8. Stay Informed

Keep up with market news and updates to make informed trading decisions:

- Market News: Follow market news and analysis from reliable sources to stay informed about economic events and market trends. The 24markets News and Analysis section provides up-to-date information.

- Economic Indicators: Monitor economic indicators that can impact market conditions, such as interest rates and GDP reports. Check the 24markets Economic Calendar for key events.

Conclusion

Opening a trading account involves several important steps, from selecting a broker to funding your account and setting up your trading platform. By following this detailed guide, you can ensure a smooth start to your trading journey. Remember to stay informed, regularly review your trading strategy, and practice with a demo account to build your skills and confidence.

For additional resources and support, explore the 24markets Education Center and the 24markets Trading Tools section.

TAGS

Latest Education Articles

Show more

Earnings Reports and Equity CFDs

Trend vs. Range Strategies

Trading Breakouts vs. Pullbacks

Hedging Basics for Intermediate Traders

Take your trading to the next level.

Join the broker built for global success in just 3 easy steps. A seamless experience built for traders who value speed and simplicity.

Create Your Account

Make Your First deposit