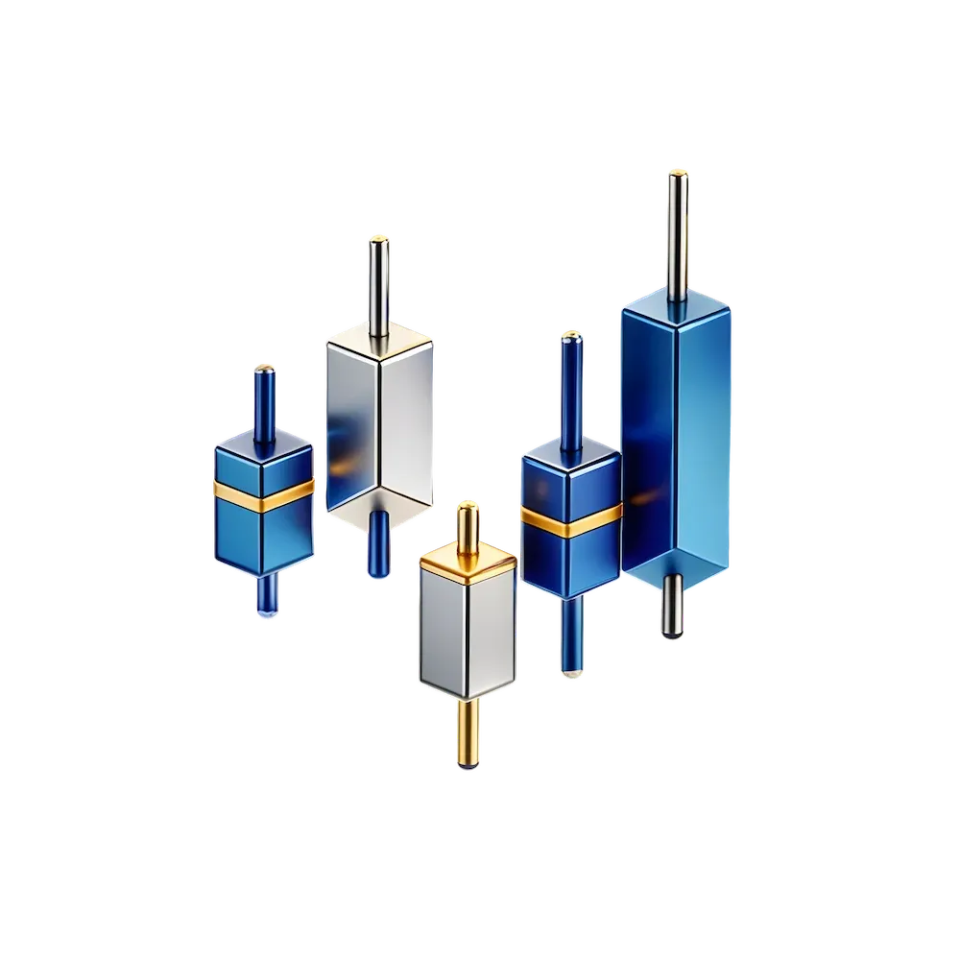

Support and resistance are those unseen barriers on trading charts that can make or break your moves. A support or resistance level acts as a psychological line where prices often pause or reverse. Support is basically the spot where prices quit falling because buyers spot a bargain and start snapping up shares. Resistance is like an overhead lid; prices climb up to it, but sellers jump in to lock in gains or short the stock, sending things back down. For example, Apple stock might dip to a support level and rebound, or get stuck trying to push past key resistance levels. Understanding support and resistance levels is super handy for figuring out buy or sell moments, and you can spot them easily with tools like TradingView. These levels come from historical price action and trader behavior, especially around round numbers like $50. Ignoring them can lead to poorly timed trades.

This guide walks you through finding these levels, understanding why they matter, and putting them to work. Give it a spin on a demo account to see for yourself.

What are Support & Resistance Explained

Think of the market like a swing.

A support or resistance level is like a key point where price tends to pause or reverse. Support is the solid floor, when the price keeps falling but repeatedly bounces off the same level. That’s where buyers jump in because they see the asset as cheap, and their buying stops the drop.

Resistance is the ceiling; the price climbs until it hits certain resistance levels where traders start cashing out or opening short positions, and the rise stalls.

These support and resistance levels often line up with previous highs or lows, or round numbers that traders naturally focus on, like 1.20 on EUR/USD. When the price breaks through resistance, that level often turns into new support, signaling a possible trend shift.

To spot them, look at charts: use hourly charts for quick trades and weekly charts for longer positions. Support and resistance levels show where the market tends to react; they take some of the guesswork out of trading.

The Role of Market Psychology in Price Levels

Support and resistance work because of how traders think and act. A support or resistance level is where buying or selling interest tends to concentrate. At support, people see a low price and get excited, thinking it’s a bargain; buyers rush in, pushing prices up. It’s like shoppers flocking to a sale. At resistance levels, traders who bought low feel it’s time to sell for profit, or others bet on a drop, creating a wall of sell orders. Round numbers, like $100 for a stock, draw extra attention because they’re easy to remember and trade around. This psychology creates patterns: Crowds place orders at these support and resistance levels, so prices stick or break with force. In busy markets, like during big economic news, these zones get stronger as more traders watch them. Knowing this helps you avoid jumping in too early or getting caught in fake moves.

Identifying Support Levels

A support level is a place on a chart where a falling price keeps stopping and turning back up. It’s like a safety net; buyers see the price as a good deal and start buying, which pushes it back up.

You can spot a support level by looking for areas where the price has bounced off the same zone several times, forming a kind of floor. For example, a stock like Microsoft might drop to a certain low during a market dip and then rebound from there.

Support isn’t always an exact number; it’s often more like a zone a few dollars wide. These support and resistance levels are remembered by traders, who place orders around them. Catching these areas early can help you plan your entries, and combining them with nearby resistance levels gives a clearer picture of likely price movements.

How to Identify Support in Price Action

Price action gives clear clues for support through how the candles move. Watch for prices dropping toward a level, then slowing down with smaller down candles or forming reversal patterns like a hammer, where the price dips low but closes near the open. This shows sellers losing steam and buyers taking over. Volume can help too, if it picks up on the bounce, it means real interest from buyers. In forex pairs like GBP/USD, you might see the price test a level several times, each with a wick touching but not breaking through, confirming support. Pay attention to these behaviors on your chart to catch support as it forms, rather than after the fact.

Using Previous Support and Key Levels

Draw on past support from earlier chart lows or important points like swing bottoms, where the price turned around before. These historical spots often hold again because traders remember them and place orders there. Key support and resistance levels include round numbers, such as $50 for a stock, or pivot points from the previous day's high, low, and close. Resistance lines mark where sellers previously stepped in, and when these resistance lines break and prices rise, that old ceiling can flip to become new support, a common switch in support and resistance analysis.

In crypto like Ethereum, past event lows, such as post-upgrade dips, serve as reliable support in later trades. Use these support and resistance levels to anticipate where buyers might enter, layering them with current action for stronger setups.

How Levels Form and What to Look For

Support levels build up from repeated buyer activity at a price point, creating a barrier as orders accumulate. It starts when prices fall, hit a zone, and buyers defend it, often with strong up candles rejecting further drops. Look for signs like increased trading activity at the level or patterns showing exhaustion, such as a series of doji candles indicating indecision before a bounce. Strong support and resistance levels align across different chart views, like a daily low matching an hourly one. Weak ones might form in quiet periods and give way easily to news. In stocks like Amazon, support often forms at earnings-related lows, where the price stabilizes after a sell-off. Using technical analysis, you can focus on these traits to distinguish solid support from temporary pauses and make more informed trading decisions.

Drawing Support Lines Effectively

To draw support lines, start by finding at least two low points on the chart where the price bounced, then connect them with a straight horizontal line. Use the body closes rather than wick extremes for a cleaner fit, and consider it a zone, not a pinpoint. In trending markets, lines might slope slightly to follow rising lows. Tools like those in MetaTrader make this easy: zoom out to see the big picture first, then adjust for details. Test your lines by scrolling back: If the price respected them in the past, they become reliable support and resistance levels. For forex, add a small buffer around the line to handle minor breaks from spreads. This approach keeps your support and resistance drawings practical and tied to real price behavior.

Identifying Resistance Levels

Resistance levels are the upper barriers where prices struggle to go higher. They form when sellers see the price as too high and start selling, creating downward pressure. Think of them as a roof on the chart, where rallies often pause or reverse. Using technical analysis, you can improve your timing by identifying support and resistance zones from past price behavior. To spot them, look for areas where the price has topped out and fallen back down several times, forming a horizontal zone. This could be in a stock like Tesla during an upswing, where it keeps hitting the same high and pulling back. These support and resistance zones give you spots to consider selling or shorting, as they show where buyer momentum fades. Like support, they're more reliable with multiple touches, turning into key decision points for trades.

Recognizing Resistance Through Price Action

In price action, resistance shows up as the stock price climbs toward a level but then hesitates or drops. You might see the up move slow with smaller green candles, or reversal signs like a shooting star where the price spikes high but closes low. This indicates sellers jumping in to push back. Volume often dips as the level nears, showing buyers running out of steam. Using technical analysis, you can spot these patterns and integrate them into your broader trading strategy. In an index like the Nasdaq, during a rally, price action at resistance might include a doji candle, signaling uncertainty before a pullback. Watch these cues closely on your chart to recognize when resistance is holding firm, helping you avoid buying into a top.

Price Breaks and Their Significance

A price break happens when the stock price pushes through resistance and stays above it, often with a strong close and higher trading activity. This signals real strength from buyers, potentially starting a new uptrend, old resistance then becomes new support on retests. But watch for fake breaks, where the stock price pokes above briefly then falls back, trapping eager buyers. In forex like USD/CAD, a solid break above a resistance line can lead to steady gains as momentum builds. Using technical analysis, traders can assess whether a break is genuine and incorporate it into a broader trading strategy. These breaks matter because they shift the market's structure, turning a ceiling into a floor and opening up higher targets. Always wait for confirmation, like a candle closing above, to trade them safely.

Combining Key Levels with Moving Averages

Pair resistance levels with moving averages to get dynamic signals that adapt to trends. For example, the 50-day moving average can act as moving resistance, where stock prices bounce down if they hit it from below during a flat period. When a static resistance like a past high aligns with a 200-day average, it creates a tougher barrier, selling there feels safer. In stocks like Google, breaking above both a round number resistance and a key average often confirms a bullish move. Integrating technical analysis into your trading strategy helps filter out noise, giving clearer entries: short at the alignment for resistance plays or buy breaks when they line up in your favor. Use charting tools to overlay them and spot these setups easily.

Candlestick Signals at Support and Resistance

Candlesticks shine at these levels, offering reversal hints. Bullish patterns at support or bearish at resistance provide clear price action signals for entries. They capture sentiment shifts, making trades more precise when combined with technical analysis tools and well-defined support and resistance zones.

Using Pin Bar Formations for Reversals

Pin bars are simple but powerful candles with a small body and a long wick, highlighting price rejection. At support, a pin bar with a long lower wick means the price declined initially, but buyers pushed it back up, it's a buy signal showing the level held. Place your entry above the bar's high and stop below the wick. At resistance, a pin bar with a long upper wick shows prices tried to rise but sellers rejected it, making a good short setup. In Bitcoin trading, a pin at a major support like $60,000 often leads to quick rebounds as it confirms the floor. Use pin bars for reversals, but wait for the next candle to close in the right direction to filter out noise and confirm price action signals.

Interpreting Price Levels with Candlestick Patterns

Candlestick patterns at levels reveal market sentiment in more detail. A bullish engulfing at support, where a green candle swallows a red one, suggests strong buying pressure, creating demand and a potential bounce. A bearish engulfing at resistance signals sellers are overpowering, a key setup in resistance trading, hinting at a drop. Other patterns like dojis show indecision, often before a big move if at a key level. In Amazon's stock, a morning star pattern (three candles building a reversal) at support has sparked uptrends by showing shifting control. Always check the pattern's fit with the level, strong ones align with high activity or news, showing that while trading has elements of art, technical analysis is also an exact science, turning a basic zone into a high-confidence trade spot.

Strategies for Trading Support and Resistance

Trading support and resistance is all about playing the levels smartly, either catching a bounce when prices reverse or jumping on a break when they push through. In a trading range, prices move between clear support and resistance, allowing traders to buy near support and sell near resistance. Watch for selling pressure at resistance levels, which can signal a likely pullback, and draw support lines on your charts to mark the floors where buyers step in. It’s like waiting for the right moment to act, whether you're trading stocks, forex, or crypto. Set simple rules: Only enter after a candle confirms the move, and check for volume to make sure the action is real. These strategies thrive on patience, letting the market show its hand before you commit, and they work across any asset you’re eyeing.

Trading Bounces and Price Breaks

For bounces, buy near support when a bullish signal appears, like a hammer candle, and aim for resistance as your target, sell there or trail your stop. Short at resistance bounces with bearish signs, targeting support below. For price breaks, wait for a close beyond the level with momentum, then buy above broken resistance (now support) on a retest, or short below broken support. In EUR/USD forex, a break above resistance at 1.10 often runs to the next round number. Use pending orders at levels for automatic entries, and add volume checks to confirm real moves over fakes.

Risk Management at Key Levels

Risk management keeps you safe around these zones, where volatility can spike. Set stops just beyond the level, below support for buys, above resistance for shorts, to give room for minor tests but cut losses fast. Limit risk to a small part of your account per trade, sizing positions so a stop hit doesn't hurt much. Trail stops as price moves your way, locking in gains during breaks. Avoid overloading on one level; spread trades across different assets like stocks and forex. In choppy markets, skip weak levels without clear signals to dodge whipsaws, keeping your overall plan steady.

Integrating Support and Resistance into Overall Price Action Strategy

Start your chart work by marking key support and resistance levels first, those past highs, lows, and round numbers that matter. Then add price action layers, like candlesticks showing up at those spots: A hammer at support could be your green light to buy. Throw in RSI to skip buys when it's overbought near resistance, say above 70. Keep a journal of your trades, noting how solid each level was and what went down, so you can fine-tune next time. Play to the market's flow: Bounce trades in sideways ranges, break trades in clear trends. Mix this with news or indicators like volume, and you've got a straightforward strategy that ties everything together nicely.

Key Takeaways for Using Support and Resistance in Trading

Support catches falling prices like a floor, resistance blocks rises like a ceiling, spot them from old highs and lows. Trader psychology makes them work, with fear and greed piling orders there. Use candlesticks for signals at these spots, going for bounces or breaks. Keep risk simple with stops and small positions. Practice on demos to get good at seeing and trading them, making these tools your edge for better results.